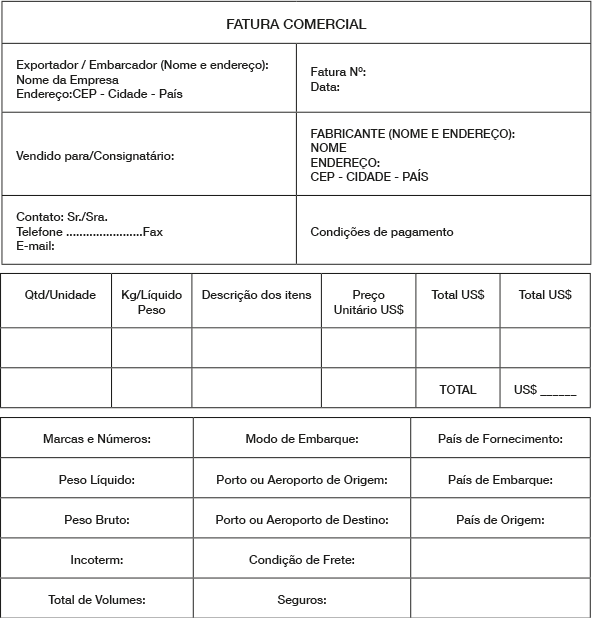

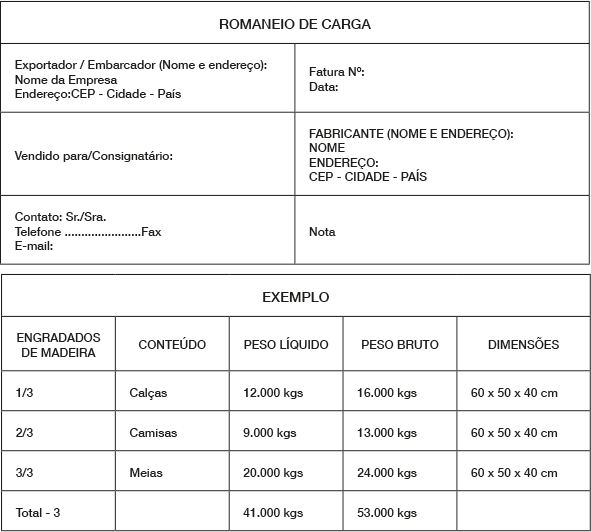

I – full identification and address of the persons involved in the transaction: importer/exporter; buyer/supplier, manufacturer, purchasing or selling agent and sales representative (stating commission percentage if any);

II – destination of the imported goods: industrialization or consumption, incorporation into assets, resale or other purpose;

III – full description of the goods: all the characteristics necessary for tax classification, species, trademark, model, commercial or scientific name and other attributes established by the Federal Revenue Office that give the goods their commercial identity;

IV – unit value (sales unit: dozen, pair, box, etc.) and net weight per item;

V – payment method (in advance, at sight, against documents, 30, 60, 90, 180 and up to 360 days or more)

VI – letterhead with signature in blue pen